Life

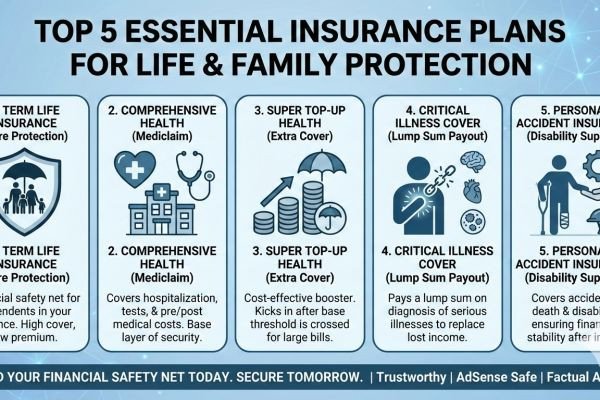

Term Life Insurance: This is a pure protection plan. If you are the primary breadwinner, this pays a large lump sum to your family in the event of your untimely passing. It is the cheapest and most effective form of life insurance.

Comprehensive Health Insurance (Mediclaim): A base health insurance plan (either Individual or a Family Floater) that covers hospitalization expenses, daycare procedures, and pre/post-hospitalization costs.

Super Top-Up Health Insurance: A highly cost-effective way to increase your health coverage. It kicks in only after a base threshold (deductible) is exhausted. This allows you to afford massive covers (like ₹50 Lakhs to ₹1 Crore) at a fraction of the cost.

Critical Illness Cover: A policy (often bought as a rider with your term plan) that pays out a lump sum if you are diagnosed with a severe illness like cancer, kidney failure, or a heart condition. This money replaces your income while you recover.

Personal Accident Insurance: Covers accidental death and, more importantly, permanent or partial disability caused by an accident, which standard term plans might not cover if the policyholder survives but cannot work.

Top 5 Insurance Companies & Their Flagship Plans (2026)

When selecting an insurer, the most critical metrics are the Claim Settlement Ratio (CSR) (how many claims they approve) and the Amount Settlement Ratio (ASR) (if they are actually paying out high-value claims without hassle).

1. HDFC Life Insurance

HDFC Life is an industry giant known for its tremendous financial stability, low complaint volume, and high claim settlement ratios (CSR consistently over 99%).

Best Plan: HDFC Life Click 2 Protect Supreme

Why it stands out: It offers highly customizable coverage, including an option that automatically adjusts your life cover based on your life stage (like marriage or having children).

2. Max Life Insurance

Max Life frequently tops the charts for its Amount Settlement Ratio (ASR), meaning they reliably pay out high-value claims without unnecessary disputes.

Best Plan: Max Life Smart Term Plan Plus

Why it stands out: It provides comprehensive pure-term coverage at highly competitive premiums, backed by some of the most efficient customer service and claims processing in the private sector.

3. Niva Bupa Health Insurance

Consistently rated as one of India's best standalone health insurers, Niva Bupa is known for rapid processing, boasting claim initiation within 30 minutes for cashless networks.

Best Plan: Niva Bupa ReAssure 2.0

Why it stands out: This is a top-selling health plan that allows your sum insured to "bounce back" or carry forward. Some variants even offer unlimited restoration of the sum insured for related or unrelated illnesses within the same year.

4. HDFC ERGO General Insurance

HDFC ERGO is a premium player in the health and general insurance space, renowned for its massive hospital network (12,000+ hospitals) and near-perfect cashless claim settlement ratios.

Best Plan: HDFC ERGO Optima Secure

Why it stands out: It offers an immediate 100% boost to your base cover from day one (e.g., a ₹10 Lakh base cover instantly gives you ₹20 Lakhs of coverage) and rewards you with further coverage increases if you don't make claims.

5. Care Health Insurance

Care (formerly Religare) is highly aggressive in providing vast hospital networks and affordable family-oriented plans.

Best Plan: Care Supreme

Why it stands out: It offers a massive network of over 21,000 healthcare providers, unlimited automatic recharge of your sum insured, and no sub-limits on room rent—meaning you aren't forced into a shared room during an emergency.